Your credit score is like your financial report card – it indicates to potential lenders how responsible you are with money. With a good credit score, you can qualify for lower interest rates on loans and credit cards. But what actually goes into calculating your credit score? And how can you improve it?

This guide breaks down everything you need to know about credit scores. We’ll cover the basics of how scoring works, why it’s important, and practical tips for monitoring and boosting your number. By the end, you’ll have a solid understanding of the key factors that shape your financial future. Let’s start with the basics.

What is a Credit Score?

Put, a credit score is a three-digit number that summarizes your credit history. Credit scores range from 300 to 850, indicating an individual’s perceived credit risk and impacting loan approvals and terms offered by lenders. Scores in the mid-600s are considered fair, mid-700s are good, and over 800 is excellent.

Your credit score indicates to potential lenders how likely you are to repay debts on time. The higher your number, the better your financial situation. Having good credit means qualifying for loans with lower interest rates, securing credit cards with larger limits and rewards programs, and receiving discounted utilities and insurance plans. So, how exactly do you get scored? The details are actually quite fascinating.

Understanding Your Credit Reports

Your credit report is a detailed record of your credit history, serving as a comprehensive snapshot of your financial behavior. It includes information about your credit accounts, payment history, and credit inquiries, all of which are used by lenders, creditors, and other organizations to evaluate your creditworthiness. The three major credit bureaus—Equifax, Experian, and TransUnion—maintain your credit report.

Here’s what you can typically find in your credit report:

- Personal Identifying Information: This includes your name, address, and Social Security number.

- Credit Account Information: Details about your credit accounts, such as account numbers, credit limits, and payment history.

- Public Records: Information on bankruptcies, foreclosures, and tax liens.

- Credit Inquiries: A record of when you’ve applied for credit.

- Credit Scores: Calculated based on the information in your credit report.

Regularly reviewing your credit report is crucial to ensuring its accuracy and catching any discrepancies early. Keeping your credit report accurate and up-to-date is a key step in maintaining a good credit score and achieving your financial goals.

How Are Credit Scores Calculated?

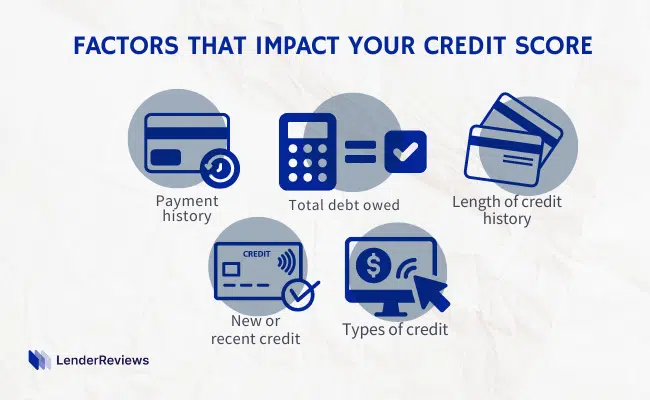

Your credit score comes from analyzing your payment history, credit usage, account age, number of recent applications, and other factors reported to the three major credit bureaus – Equifax, Experian, and TransUnion. Each bureau has its proprietary formula, but they mainly consider these common points:

- Payment History (35%) – This is the single most important factor. Paying bills on time shows responsibility to lenders. Even one missed payment can ruin your score.

- Credit Utilization (30%) – How much of your available credit are you using? Try not to charge over 30% of your credit limit to keep utilization low.

- Credit History Length (15%) – The longer your accounts have been open, the better. Closing old accounts can hurt your average account age.

- New Credit (10%) – How many applications have you submitted for new lines of credit recently? Avoid applying for too much at once.

- Credit Mix (10%)—Having a variety of installment loans (mortgages, auto loans) and revolving credit (credit cards) shows that you handle different types of debt responsibly.

In summary, your payment habits, credit balances, account history, applications, and diversity of credit all affect your final credit score number. Now that we have the basics down, let’s talk about why this even matters.

Credit Score Ranges and Interpretation

Credit scores, which range from 300 to 850, are calculated based on the information in your credit report. The most widely used credit score is the FICO score, developed by the Fair Isaac Corporation. Understanding where your score falls within the credit score ranges can help you gauge your credit health and take appropriate action.

Here are the general FICO credit score ranges and their interpretations:

- Excellent Credit: 720 and higher

- Good Credit: 690-719

- Fair Credit: 630-689

- Bad Credit: 629 or lower

A higher credit score indicates a better credit history and a lower risk for lenders, which can help you qualify for lower interest rates, better loan terms, and higher credit limits.

It’s important to note that credit score ranges can vary depending on the credit scoring model used. For example, the VantageScore model, which some credit bureaus use, has slightly different ranges:

- Excellent Credit: 750 and higher

- Good Credit: 700-749

- Fair Credit: 650-699

- Bad Credit: 649 or lower

Understanding these ranges can help you interpret your credit score more accurately and take steps to improve it if necessary.

Why is Your Credit Score Important?

Sure, your score may seem like a meaningless number, but it has far-reaching implications. First off, here’s how it directly impacts your finances:

- Loan Approval – Most lenders will only consider applicants with scores over 620. Higher scores mean you’re more likely to pre-qualify.

- Interest Rates – Banks often reward excellent scores (780+) with their lowest advertised rates. A low score equals higher interest on debt.

- Credit Limit Increases – Card issuers review your payment activity and may boost your limits if your score is in good standing.

- Employment Checks – Some companies review credit as part of background/security screening. Bad finances could hurt your chances of getting hired.

- Rentals – Landlords frequently pull credit and bank statements to analyze tenants. Scores under 650 may result in an application denial.

So, as you can see, your creditworthiness matters a great deal when it comes to accessibility, affordability, and necessities. Maintaining a high score puts you in control of your financial future. Let’s explore some best practices for boosting your number.

How to Improve Your Credit Score

The keys to optimization focus on responsible credit habits that reassure potential lenders of your trustworthiness. Here are some science-backed methods:

- Pay on Time – Settle bills and minimum payments by the due date each month to keep a clean record. Even one 30-day late hit can take 30+ points off your score.

- Keep utilization Low – Try to charge less than 30% of your credit limits, as high balances concern issuers. Some advise keeping cards at 1-10% utilization to maximize your score.

- Lengthen History – Simply using accounts responsibly over time helps your average age of accounts and mix of credit mature positively.

- Apply Strategically – Too many applications within a short period (like for new cards) seem risky and ding your score each time with hard inquiries. Space them out.

- Fix Errors—Occasionally check your credit reports for inaccuracies and dispute them promptly by contacting the bureaus. Small mistakes can hurt your score.

- Pay Down Balances – Gradually pay down credit card balances to the lowest possible statement balances to optimize utilization before your statement closes.

Following these steps diligently over 6 months to a year should yield clear score improvements. But don’t expect magic – patience and responsible habits are key for long-term gains. Now that we’ve covered scoring fundamentals and optimization strategies, it’s time to address some common concerns and missteps to avoid.

Common Credit Score Mistakes to Avoid: Payment History

Keeping your financial house in order takes vigilance, especially to sidestep these all-too-common errors:

- Not Checking for Errors—Mistakes happen on our reports. Pull yours annually from AnnualCreditReport.com and check for data integrity issues that can slow accurate scoring.

- Ignoring Credit Utilization—Usage proportions are tracked month-to-month. Stay mindful of balances reported to bureaus and keep cards parked at a 1-9% limit for maximum headroom.

- Opening Multiple Accounts—Each application results in a hard inquiry that temporarily lowers your score a few points. Space new credit lines several months apart to minimize denials.

- Forgetting Old Accounts – Your score includes average age metrics like the average age of accounts and credit lines. Never close your oldest cards, as that age drops hurt you long-term.

- Missing a Payment—Even one blemish can cost you 30+ points, and without good habits, it can take 6 months to recover fully. Set automatic payments or calendar reminders.

- Not Managing Authorized Users—Anyone you designate gets full access to monitor and damage accounts under your name by missing payments or maxing out balances you must pay for.

With information comes power – stay alert to subtle actions affecting your financial rating. Regular self-audits promote responsibility and maximize your number over the long haul for interests. Consider tracking with service apps, too, for comprehensive oversight.

In summary, keep accurate records, monitor your utilization and behaviors, avoid multiple applications, maintain open long accounts, automate payments, and manage authorized users properly. This ensures optimized scores you can feel secure with going forward.

Credit Report Errors and Disputes

Errors on your credit report can occur for various reasons, such as incorrect information, outdated data, or even identity theft. If you find an error on your credit report, it’s essential to dispute it with the credit bureau as soon as possible to maintain a good credit score.

Here are the steps to dispute a credit report error:

- Review Your Credit Report: Carefully examine your credit report and identify any errors.

- Gather Supporting Documentation: Collect evidence such as receipts, bank statements, or identification that supports your claim.

- Contact the Credit Bureau: Submit a dispute request to the credit bureau that issued the report.

- Wait for Investigation: The credit bureau will investigate your dispute and respond within a reasonable timeframe, usually 30-45 days.

- Verify Corrections: If the error is corrected, request a new credit report to ensure the changes are reflected.

Credit bureaus are legally required to investigate and respond to disputes within a reasonable timeframe. If the error is not corrected, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s Attorney General’s office.

Regularly monitoring your credit report and promptly disputing any errors is crucial for maintaining an accurate credit history and achieving a good credit score. By doing so, you can ensure your credit report accurately reflects your financial behavior and helps you reach your financial goals.

Some Effective Strategies for Rebuilding Credit After a Setback:

- Check Your Credit Reports: Pull your credit reports and scrutinize them for any inaccurate negative items or outdated collections/late payments that can be disputed and removed. Addressing errors is key.

- Pay All Bills on Time: If you’ve had late or missed payments in the past, make perfect on-time payments for at least 6 months straight to demonstrate changed behavior to lenders. Set calendar reminders.

- Become an Authorized User: Ask a family member with excellent credit if you can be added as an authorized user on one of their oldest accounts. This will instantly tie their positive history to your reports.

- Secure a Secured Credit Card: Apply for starter credit cards from Discover or Capital One that require a refundable security deposit as collateral. Use lightly and pay in full each month to generate a positive payment history.

- Apply for Credit Builder Loans: Non-profit organizations offer low-limit personal loans reported to bureaus where on-time payments help rebuild your score over 12-48 months of installments.

- Consider Credit Counseling: Programs like GreenPath can advocate for you with collectors, consolidate debts if applicable, and provide financial education to get your credit and budget back on track.

- Be Patient and Consistent: Rebuilding credit takes time and persistence. Avoid applying for new credit until your score notably improves, typically 6-12 months of on-time payments, and lower credit utilization or debt levels each month. Perseverance pays off.

Checking Your Credit Report

Now that you know how to interpret your score, you may wonder: how do I view my actual number? Obtaining a free credit score is easy and can be done in just a matter of minutes. Luckily, there are both free and paid options available: Free credit scores are available through various platforms such as Credit Karma and credit card companies.

- AnnualCreditReport.com – The official site offers your FICO report from each bureau annually, free of charge. Check regularly to monitor changes.

- Credit Karma—This app provides VantageScore 3.0 estimates from TransUnion and Equifax regularly throughout the year at no cost. It is useful for tracking progress between reports.

- Credit Sesame – Another free website offering VantageScore similar to Credit Karma for free ongoing tracking capabilities.

- Experian Boost – This service through Experian refreshes scores by incorporating positive bill payment history to see potential gains.

- Paid Monitoring: For a small fee, Sign up with Equifax, Experian, or TransUnion directly to receive FICO scores and full credit reports each month.

Conclusion

Whatever method you choose, aim to pull your credit at least quarterly. This ensures the most up-to-date view of your number and flags any unexpected activity that warrants further review. It’s always wise to stay aware of sensitive financial data.

With diligence and perseverance, prudent credit management adds points over time. Keep making healthy financial decisions and address any issues promptly for long-term rewards in accessing loans, credit platforms, and life opportunities at your optimal rates. Your future depends on the foundation you lay today.

Maintaining great credit requires ongoing self-education, patience, and well-timed actions. We hope this guide clarifies scoring factors and everyday strategies for optimizing your number. Remember, lenders value reliable customers, so focus on cultivating responsible habits through consistent, small improvements. Stay on top of your financial health for future savings and peace of mind.

Build Credit Accounts and Score with Lender Reviews

Rebuilding credit following a setback requires commitment and diligence over time. But by establishing responsible payment habits, contesting errors, securing starter credit opportunities, and focusing on the long game, you can get your finances back on the right track.

If you’re currently working to rebuild low credit, Lender Reviews recommends exploring credit counseling services in your area. Certified credit experts can guide you with a personalized repayment plan, dispute errors aggressively on your behalf, and provide the accountability needed to stay motivated.

Lender Review to Save You

Some even offer low-cost secured credit cards and small loans exclusively for clients enrolled in debt management programs. Lender Reviews has reviewed many credit counseling agencies nationally and identified some top-rated nonprofits with a proven track record of success.

Visit LenderReviews.org for a referral to book a free consultation with one of our highest-ranked providers. Our team of advisors stands ready to answer questions and ensure you connect with the ideal program for your unique situation.

By taking active steps like repairing blemishes, automating payments, and utilizing credit-builder options, there is light at the end of the tunnel. With persistence and insight from professionals, anyone can bounce back from temporary struggles.

Regaining control of your finances starts with just one small, empowered choice today. What have you got to lose by making that choice be a free counseling appointment?